Managing a trust or complex estate is a demanding task that requires specialized training and experience. If you don’t know the rules of trusts or how to administer an estate, you could lose a lot of money for yourself or a family member. In some cases, you could find yourself in legal trouble if you mismanage a trust or estate. Fortunately, you don’t have to administer a trust or estate by yourself if you hire a capable attorney.

At Pennington Law, PLLC, our West Valley Arizona estate administration attorneys have the knowledge and experience to manage even the most complicated trusts or estates. Our trust administration attorney have helped people all over Arizona, from Sun City West and Peoria to Buckeye and Surprise. No matter what kind of trust you need us to manage or how complex an estate is, our trust administration attorney can make the legal process smoother and less taxing for you. Call us today or visit our contact page for your free consultation.

What Is Trust Administration?

A trust, at the most basic level, is a legal instrument that allows someone to manage certain assets on behalf of a beneficiary. Setting up a trust correctly enables the grantor (the person who creates a trust) to pass on the assets in the trust after the grantor dies without going through probate. Setting up a trust can also help a grantor pass on more of their assets by avoiding certain estate or income taxes.

Every trust is different, and some require more work to manage than others. When administering a trust, the trustee must manage the assets to benefit the beneficiaries, not the trustee. Administering a trust includes everything from keeping track of the assets and distributing funds to beneficiaries to taking care of taxes and dealing with any disputes among the beneficiaries.

What Are the Benefits of Trust Administration?

Pennington Law, PLLC, we are skilled in administering a wide variety of trusts, including generation-skipping trusts, living trusts, QTIP trusts, charitable remainder trusts, credit shelter trusts, and more. The benefits of hiring attorneys who are seasoned trust administrators include the following:

- Filing Estate Planning Documents with the Courts –An Arizona trust and estate administration attorney can take care of the court paperwork related to a trust or estate and file those records correctly.

- Finding and Keeping Track of Assets – If the estate is large and complicated, it may be difficult to track down the assets that were included in the trust. A trust administration can find those assets and manage them appropriately, along with other assets included in the trust.

- Probating the Estate – A skilled estate administration attorney knows how to open a probate estate and manage all the required court filings and notices. You won’t have to track down creditors or heirs because the attorney can do that for you.

- Valuing, Managing, and Liquidating the Estate – An attorney can manage the estate prior to the grantor’s death, making sure to wisely handle assets for the benefit of the beneficiaries. They can have the estate valued after the grantor’s death and determine how to liquidate those assets that must be sold.

- Distributing Assets to Beneficiaries – Having a neutral party administer a trust means they can distribute the assets according to the grantor’s wishes without pressure from family members or heirs. This approach helps beneficiaries avoid disputes because they know the trust administrator has no stake or emotional involvement in who receives what assets.

- Hiring Experts as Needed – If experts are required to evaluate a business or other trust asset, an experienced trust administration attorney will have the resources to know which evaluators would be appropriate and have the valuation completed.

- Locating Beneficiaries – Depending on who the grantor names as the beneficiaries of a trust, those beneficiaries can be hard to find. A trust has little value if the beneficiaries can’t access the assets, but a trust administration attorney can track down any missing heirs.

- Resolving Disputes Among Beneficiaries – Having a neutral party manage a trust is a smart way to avoid conflicts among beneficiaries. When the trustee is not a member of the grantor’s family or a close friend, resolving any disputes is easier because the trustee has no emotional or financial ties that could impact their judgment.

- Taking Care of Taxes – One of the most common issues people run into with trusts is not paying the appropriate taxes. A trust administration lawyer will know what taxes may apply and pay them accordingly, which helps the beneficiaries avoid any legal trouble.

Who Is a Trustee and What Do They Do?

The person who oversees the trust is called the trustee. The trustee’s job is to manage the trust according to the grantor’s wishes, take care of any legal issues related to the trust, and distribute assets to the trust’s beneficiaries.

It is crucial to know that a trustee must manage the trust according to the grantor’s wishes and in a way that benefits the beneficiaries, not the trustee. A trustee who mismanages a trust or keeps the assets for their own benefit could face severe legal consequences.

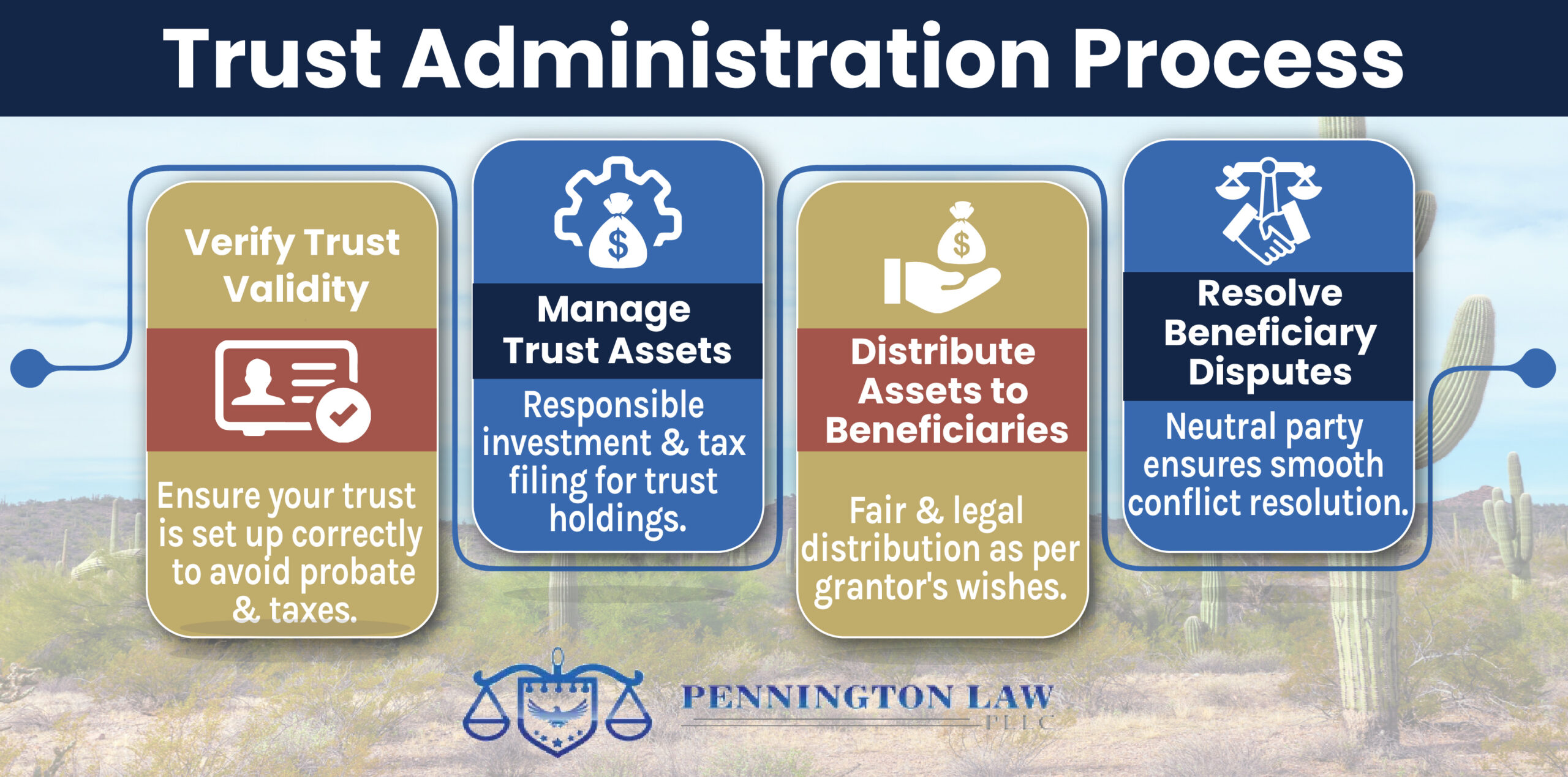

What Is Involved in the Trust Administration Process?

The components of the trust administration process include:

- Verifying the Trust’s Validity – One of the advantages of hiring a trust administration attorney to help you with your trust administration duties while the grantor is still living, is that they can verify that the trust is set up correctly and fix it if something is amiss. If the trust is invalid, the heirs will likely have to go through the probate process to claim any assets from the deceased’s estate. Failing to set up a trust properly might also mean the deceased’s beneficiaries have to pay taxes on the estate, meaning they won’t keep as much of the assets.

- Managing the Assets in the Trust – Once the grantor places assets in a trust, the trustee is responsible for managing them appropriately and preparing annual tax returns on the trust assets while the grantor lives. The trustee is also responsible for distributing the assets according to the grantor’s stated wishes in their will or other estate planning documents after they pass. In addition to distributing assets, the trustee must keep track of the trust’s assets, pay any necessary taxes, and take care of any legal requirements related to the trust.

- Resolving Disputes Among Beneficiaries – When a trust has multiple beneficiaries, there is a chance they will argue over who gets what assets or how to distribute them. The trustee’s job is to settle these disputes while following the grantor’s stated wishes. Having a neutral party manage a trust makes it much easier to resolve these disputes.

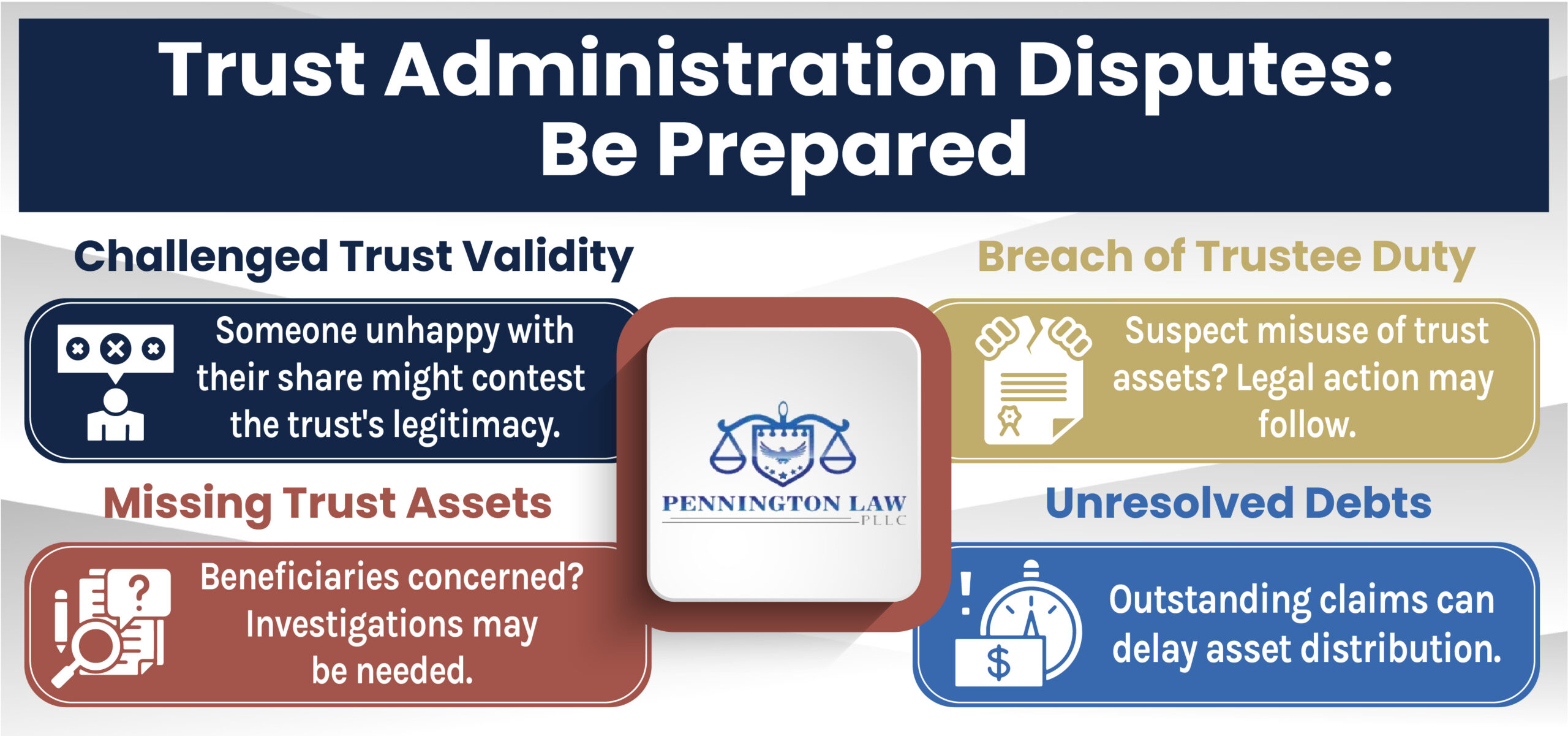

What Are Common Disputes that Arise in a Trust Administration?

Some of the most common disputes over trusts that we see at our firm include:

- Contested Trust – It’s common for people to argue that a trust is invalid if they feel like they are not getting a fair share of the estate’s assets.

- Breach of Fiduciary Duty – The law says trustees must act in the best interest of the trust’s beneficiaries, not themselves. If a beneficiary believes the trustee is using the trust for their own financial gain, they might take legal action against the trustee.

- Accounting Disputes – When a trust includes many or complicated assets, there is a chance for assets to go missing, either by accident or through mismanagement. If a beneficiary believes they have not received their rightful share of the trust’s assets, they might ask for an independent investigation to determine if any assets have gone missing.

- Claims Against the Estate – If a trust’s grantor dies and a government or other entity has a claim on the estate, the trustee must resolve those issues before distributing any assets to beneficiaries. However, not all claims against an estate are valid, and the trustee should thoroughly investigate any claims against the estate or trust.

What Can an Arizona Trust and Estate Administration Attorney Do?

Administering a trust requires a significant amount of time and energy. There are many rules to obey, records to file or manage, and potentially difficult beneficiaries to talk to. An Arizona trust and estate administration lawyer can take these tasks off your hands while making sure you’re complying with any applicable laws. Better still, letting an attorney administer a trust or estate means unhappy beneficiaries can complain to them instead of you. Hiring an attorney to administer an estate or trust means fewer headaches for you and a smoother process for everyone involved.

Talk to a Surprise, Sun City West, Peoria, and Buckeye, AZ, Trust Administration Attorney Now

If you need help administering a trust or have questions about setting one up, speak to a West Valley Arizona estate planning attorney immediately. The sooner you talk to a lawyer, the more time you have to make sure the process goes smoothly and reduce the chance of any mistakes.

Call Pennington Law, PLLC, today or visit our contact page to learn more about our estate and trust administration services.